Mutual

Description of Mutual

People lending to people, simple as that.

For us, believing in people is giving credit. We help you get loans quickly and personalized, with payment terms that fit your budget.

For this, we gathered thousands of Brazilians who invest in credit seeking to help those who need money to achieve their goals.

Interested? So follow some important information for you. :)

We were the first platform to grant loans directly between individuals, we revolutionized personal credit in Brazil and today we are the leader in this segment.

It's all online, you just need to install the application and apply for your loan.

Credit application in just a few minutes

Get your loan online, without leaving home and without wasting time on bureaucracy.

Customized credit analysis

We define the payment terms, according to your credit history.

Most affordable interest rates

Fixed monthly installments that you can pay, preserving your budget and your financial health.

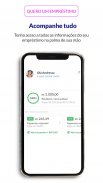

Debt Management

All payment management of your loan takes place through its own technology via the application, with a support team responsible for collecting and issuing bank slips.

Agile Technology

We have the fastest technology in Brazil in analysis, credit origination and our own creation of score analysis methods.

Information about the loan

During the loan application process, you will receive information about all conditions related to your application. The minimum period for payment of the installments is 6 (six) months and the maximum period is 18 (eighteen) months, with a minimum interest rate of 2.3% per month up to 12% per month (minimum annual rate of 31.37% up to at most 289.60%).

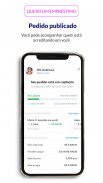

Loan simulation example:

Order value: BRL 1,500.00

Installment payment period: 12 months

Interest rate: 5.48% per month (89.69% per year)

IOF: BRL 38.40

CET: 7.98% per month (151.23% per year)

Total installments: 12 installments of BRL 209.15

Total amount payable: BRL 2,509.80

After placing your order, payment information is available in the application for your control.

----

IMPORTANT: Like investments in debentures and stocks, Mutual is a risky investment. Indicated only for investors with this profile.

Mutual is an institution authorized to operate by the Central Bank of Brazil. MUTUAL INTERMEDIAÇÃO DE NEGOCIOS PAGAMENTOS E COBRANÇA S.A., CNPJ: 24.285.984/0001-62. Our office is located at Av. Marechal Floriano, 45, Downtown, Rio de Janeiro / RJ - CEP 20080-901. Telephone service from Monday to Friday, from 8am to 6pm, by number (21) 3609-8851.